The COVID-19 pandemic has had dramatic implications for workplace retirement programs. Volatile market conditions have organizations and individuals reviewing their financial options. At the same time, these conditions have led to interruptions in employment, as employers contemplate and implement furloughs, hiring freezes, hour reductions and even layoffs. What retirement-based actions are employers and workers making due to the COVID-19 pandemic?

These questions were asked as part of the International Foundation survey report Employee Benefits in a COVID-19 World.

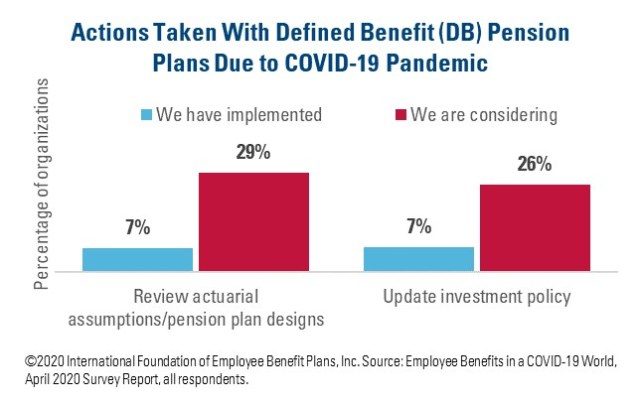

Defined Benefit (DB) Pension Plans

Respondents were asked about changes made to their defined benefit pension plans due to the implications the COVID-19 pandemic. About two in five (38%) responding organizations offer a DB pension plan, with much higher prevalence in the multiemployer (78%) and public employer sectors (78%).

While few responding organizations are taking significant actions with their DB plans due to COVID-19 implications, at least a quarter are considering reviewing their actuarial assumptions/pension plan designs (29%) and updating their investment policies (26%). It should be noted that more than one in seven (15%) responding multiemployer funds have already reviewed their actuarial assumptions/pension plan designs due to COVID implications.

Defined Contribution (DC) Retirement Plans

About nine in ten responding organizations (87%) offer a defined contribution retirement plan with prevalence more common among corporate (94%), followed by public (77%), and multiemployer (67%) respondents.

About 13% of responding organizations that offer DC plans are noticing a greater share of their participants making changes to their contribution/deferral levels compared with pre-COVID-19 levels, while 7% are noticing a smaller share. Those noticing a change are most often noticing their workers decreasing (86%) their contributions, while 54% are noticing participants canceling or stopping contributions completely.

More than one in six (17%) respondents said that more participants are taking hardship withdrawals from their DC accounts due to the COVID-19 pandemic, while 42% have noted no change. Respondents from multiemployer funds (35%) were more likely to notice an increase in the number of participants taking hardship withdrawals.

Similarly, 11% of respondents stated that more participants are taking loans from DC accounts as a result of the COVID-19 pandemic, while 42% noted no change.

From the employer side, responding organizations were asked if they were making changes to DC plan matching contributions. Of those that offer matching, relatively few organizations are making changes as a result of the COVID-19 pandemic. Just 1% have reduced the amount of their matching contribution, while 7% have suspended or eliminated their matching contribution. Going forward, about 19% are considering making changes in the future.

Note: Data from this blog does not include actions based on retirement-based provisions of the CARES Act. For specific information on those actions see Plan Sponsors Providing More Benefit Options Thanks to CARES Act Provisions.

[Upcoming Webcast: Common-Sense Investment Approaches to New Economic Realities | June 2, 2020]

Staffing Changes

As mentioned, changes in service can leave gaps in worker income, while interrupting contributions to retirement plans. To give context to actions taken, respondents from the corporate and public employer sectors were asked about staffing changes being made at their organizations.

More than two in five single and public employers (45%) are implementing a temporary hiring freeze, with an additional 12% considering doing so in the future. In addition, 29% are temporarily furloughing workers, with 14% considering doing so in the future. While less common, respondents are also reducing workers’ hours (27%) and laying off workers/reducing their workforce (19%).

Learn More

Employee Benefits in a COVID-19 World provides data on a variety of benefits including health care, prescription drug, mental health and short-term disability, as well as retirement plans.

Visit the International Foundation Coronavirus (COVID-19) Resources page to find even more resources for plan sponsors, including these upcoming Foundation webcasts:

- Capping Medical Plan Costs and Improving Care in the Aftermath of COVID-19 | May 21, 2020

- Current Accounting and Auditing Issues in Employee Benefit Plans | May 27, 2020

- Governance and Oversight Issues for Multiemployer Plan Sponsors During the Pandemic | May 27, 2020

- Building High-Performing Remote Work Teams | June 3, 2020

Justin Held, CEBS

Senior Research Analyst at the International Foundation

The latest from Word on Benefits:

- Mental Health Parity: What Plan Sponsors Need to Know During Period of Nonenforcement of 2024 Final Rule

- CMS Creditable Coverage Updates for Group Health Plans

- The New Look of Virtual Care: What’s Right for Employers and Plan Sponsors?

- Ontario’s New Long-Term Illness Leave Takes Effect Soon: What Employers Need to Know

- What Benefits Are Working? Attracting and Retaining Employees