Business closures and curtailments due to the coronavirus pandemic have left many organizations and individuals struggling financially. The Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted on March 27, 2020 with the goal of providing quick financial relief to citizens and employers. Part of this relief came in the form of employee benefit expansions.

During the last week of April, the International Foundation of Employee Benefit Plans conducted a survey, Employee Benefits in a COVID-19 World, to determine how the pandemic is affecting employee benefit plans. As part of this survey, we posed questions to find out how many plan sponsors are offering the expansions allowed by the CARES Act.

Defined Contribution Retirement Plans

The CARES Act included a number of provisions related to defined contribution (DC) retirement plans, such as 401(k) plans, 403(b) plans and 457(b) plans. The law allows easier access to money saved in these retirement plans by loosening rules related to early distributions and loans. These new provisions are available until December 31, 2020 and can be offered only to plan participants who meet specified criteria related to COVID-19.

Coronavirus-Related Distributions

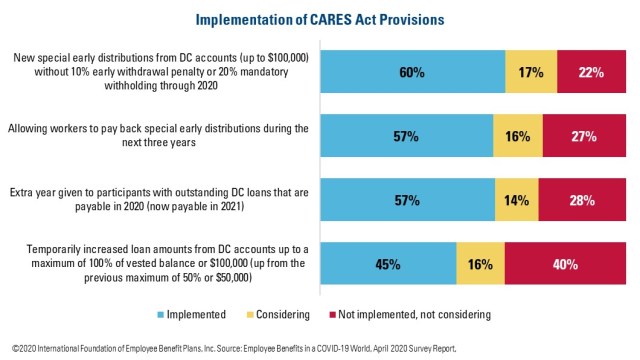

The CARES Act created a new type of distribution, a coronavirus-related distribution (CRD), that allows participants to access up to $100,000 in their DC retirement accounts right away, but without the 10% penalty and 20% mandatory federal tax withholding typically required when early withdrawals are made. Plan sponsors are not required to offer CRDs, but our survey found that many do. Among those we polled, 60% are offering CRDs, and another 17% are considering offering them. Fewer than a quarter (22%) of plan sponsors have decided not to implement them.

One attractive feature of CRDs is that plan sponsors can allow participants to pay back the money that is withdrawn. Our survey shows that 57% of plan sponsors are allowing repayments, and another 16% are considering do so. If allowed, participants have up to three years to repay all or some of the CRD to any qualified plan or individual retirement account (IRA) that accepts rollovers. Not only do repayments help restore retirement savings, they can help minimize income tax liability.

Retirement Plan Loans

DC plan loans are another way that participants can gain access to retirement funds before retirement, and 84% of the plan sponsors surveyed offered plan loans before the pandemic. The CARES Act loosened some restrictions for plan loans and allows plan sponsors the option to increase the amount that a participant may borrow. Before the CARES Act, plan loan limits were set at 50% of a participant’s vested account balance up to $50,000. The CARES Act doubled those limits to 100% of a participant’s vested balance up to $100,000 for loans taken out through September 22, 2020. More than two in five (45%) survey respondents have adopted that provision, and another 16% are considering it. Plan sponsors can also help participants by offering the option to temporarily delay loan repayments in 2020. For participants who have outstanding DC plan loans with repayments due between March 27, 2020 and December 31, 2020, the CARES Act allows them to delay their loan repayments for up to one year, although interest will continue to accrue on these delayed payments. More than seven in ten of the plan sponsors surveyed are offering this option (57%) or considering doing so (14%).

Why Plan Sponsors May Not Offer Distribution Expansions

Although the CARES Act distribution expansions may offer workers a quick source of much-needed cash in these difficult economic times, there are risks. Plan sponsors may choose to not offer CRDs and greater loan limits because they are concerned about the future retirement security of their participants. Making it easy to withdraw retirement funds does not serve plan participants well. To get the most benefit from the “magic” of compound interest, participants should let their money sit undisturbed for decades. Every time participants withdraw or borrow money, they make it more difficult for their savings to compound. Plan sponsors may wish to educate workers about the potential impact of early distributions and plan loans so participants can make an informed choice.

Defined Benefit Pension Plans

For employers in the private sector with defined benefit (DB) pension plans, the CARES Act provides funding relief by allowing these organizations to defer their required 2020 minimum pension contributions until January 1, 2021. Among the private sector employers polled, 20% offer a DB pension plan. At the time of the survey, more than half (54%) of plan sponsors had not chosen to pursue or consider this option. More than two in ten (22%) had chosen to delay minimum contributions, and nearly a quarter (24%) more were considering this option. The law did not make this deferral available to governmental plans or multiemployer pension plans.

[Related Reading: Steps Plan Sponsors Should Take to Implement the Families First Act and the CARES Act]

Student Loan Assistance

In response to the heavy student loan debt burden carried by workers of all ages, student loan debt assistance has received growing attention as a desired employee benefit. The CARES Act offers some help in this area during 2020. For plan sponsors with Internal Revenue Code Section 127 educational assistance programs, the new law expands the list of tax-free reimbursable expenses (up to $5,250) to include student loan debt in addition to tuition and textbooks. Of the organizations polled, 25% offer Section 127 programs. Of those, relatively few (10%) organizations are taking advantage of this provision, but an additional 13% are considering it.

Learn More

Employee Benefits in a COVID-19 World provides data on a variety of benefits including health care, prescription drug, mental health and short-term disability, as well as retirement plans. The survey also addresses staffing changes and professional development programs.

Visit the International Foundation Coronavirus (COVID-19) Resources page to find even more resources for plan sponsors including these upcoming Foundation webcasts:

- Pension Trustees and Effective Governance of Climate-Related Risks | May 14, 2020

- Capping Medical Plan Costs and Improving Care in the Aftermath of COVID-19 | May 21, 2020

- Current Accounting and Auditing Issues in Employee Benefit Plans | May 27, 2020

![]()

Kelli Kolsrud, CEBS

Director, Research and Publications at the International Foundation

The latest from Word on Benefits: