A new survey report from the International Foundation of Employee Benefit Plans reveals U.S. employer coverage and considerations surrounding glucagon-like peptide-1 (GLP-1) drugs, which have historically been used to treat diabetes. These drugs were also found to cause weight loss and have been subsequently used to treat obesity.

Among survey respondents, 76% provide GLP-1 drug coverage for diabetes, 27% provide coverage for weight loss, and 13% are considering covering for weight loss.

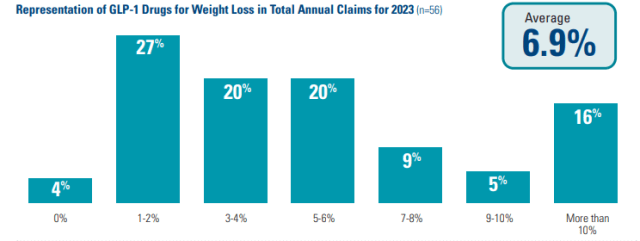

In 2023, the average representation of GLP-1 drugs used for weight loss in employers’ total annual claims was 6.9%, according to survey respondents. Those who are covering GLP-1 drugs are relying heavily on utilization management (79%) to control costs. A less common approach (32%) is step therapy. Fourteen percent of employers have no cost control mechanism in place.

“Though GLP-1 drugs have a high price tag, they currently represent only 6.9% of annual claims, according to survey respondents,” said Julie Stich, CEBS, Vice President of Content at the International Foundation. “Employers can take this information into account when designing long-and short-term benefit strategies.”

The most prevalent factor employers take into consideration for GLP-1 drug coverage for obesity care include:

- Obesity as a risk factor for chronic conditions and associated costs—63%

- Long-term costs—55%

- Impact/effectiveness of cost-control mechanisms—54%

- Broker/consultant/PBM recommendations—50%

- Lack of long-term use clinical studies of GLP-1 drugs—46%

Find more information and view the latest GLP-1 Drugs survey report.